First and unique

IMAN Invest Halal Investment Company

Thousands of investors trust us with their money because we provide the most convenient way to grow wealth and attain objectives in an ethical and permissible manner.

200k +

App downloads

40k +

Investors with us

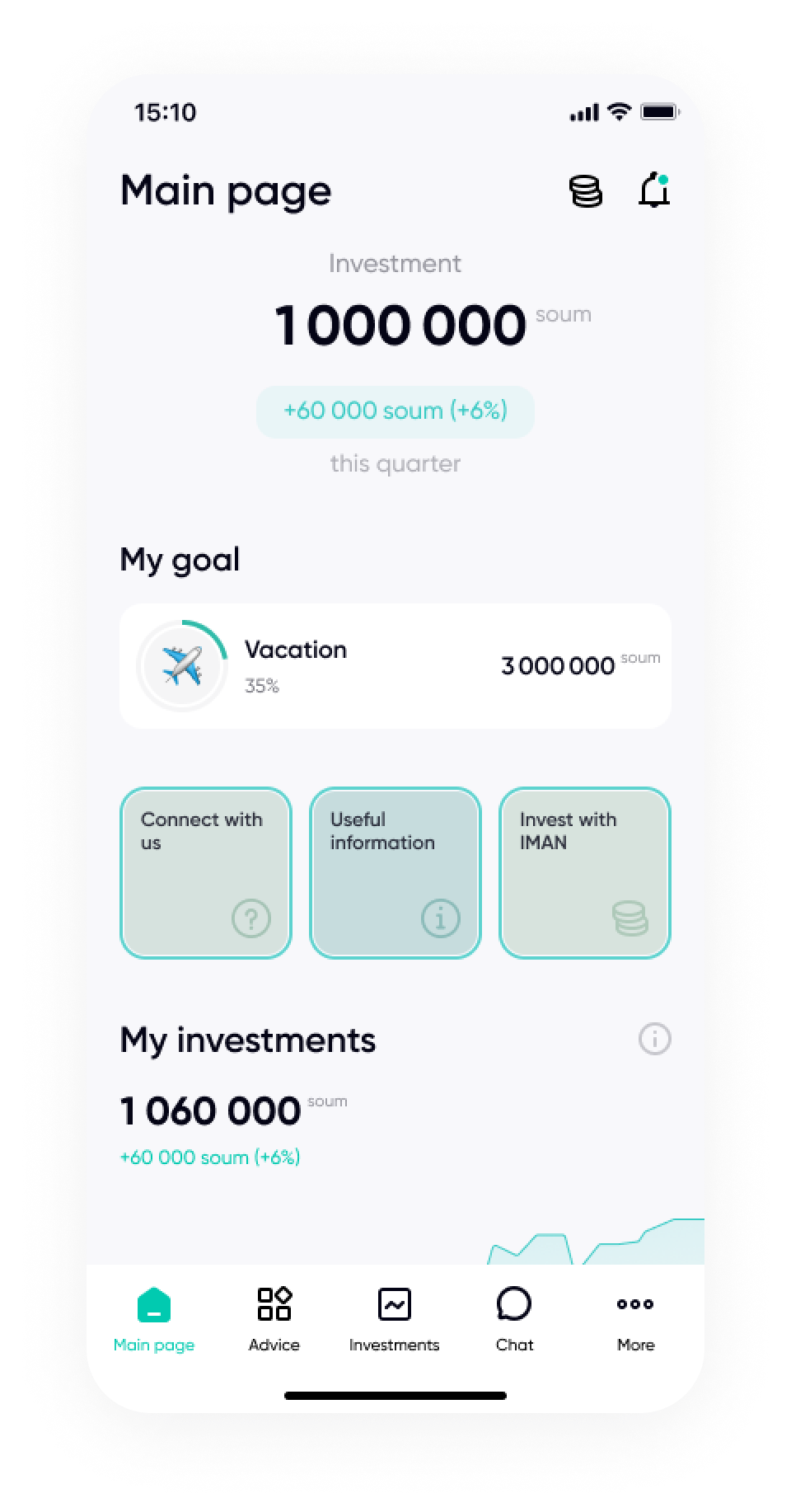

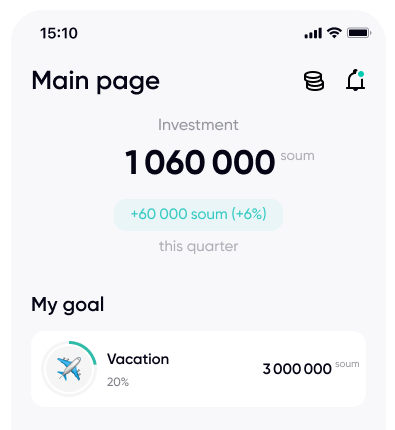

What do you want to save for?

A goal will help you track your progress.

Add your goal

Hajj/Umrah

Automobile

Vacation

Wedding

House

Education

Children’s portfolio

How Does Iman Work?

Learn everything about setting up an account, investment process, portfolio diversification, and profit distribution

More

Shariah Compliance

Compliance with the principles of Islamic finance is confirmed by the Board of Muslims of Uzbekistan, as well as by Sheikh Dr. Ziyad Mohammed from Malaysia

More

Mudaraba-Installments investment strategy

starting from 500.000 sum

The first investment

19-24%

Projected annual return

1.5-2% every month

Projected profit

from 100k sum

follow-on investments

Monthly

Reinvesting profits

Unlimited

Investment term

Calculate yield

Profit calculator

Initial Investment

25 mln

Monthly Investment

3 mln

Investment term

18 year

Starting year

Total earned

NaN сум

Total invested

673,000,000 сум

Initial Investment

25 mln

Monthly Investment

3 mln

Investment term

18 year

The latest news

Uzbekistan super app intends to attract a billion users worldwide

27 May 2022

The number of Iman Pay outlets exceeded 350

27 May 2022

IMAN attracted $1 million investments

22 February 2022

Central Asian Venture Forum

9 June 2022

World Economic Forum

3 June 2022

Uzbekistan super app intends to attract a billion users worldwide

27 May 2022

The number of Iman Pay outlets exceeded 350

27 May 2022

IMAN attracted $1 million investments

22 February 2022

Central Asian Venture Forum

9 June 2022

World Economic Forum

3 June 2022

Uzbekistan super app intends to attract a billion users worldwide

27 May 2022

The number of Iman Pay outlets exceeded 350

27 May 2022

IMAN attracted $1 million investments

22 February 2022

Frequently Asked Questions

How does IMAN work?

IMAN directs funds received from investors to finance the sale of goods and services in installments. Examples include household appliances, furniture, auto parts, electronics, sporting goods, medical care, treatments, surgical operations and training courses. Customers make payments on these purchases over time with a margin ranging from 0% to 35%. If a 0% margin is applied, IMAN is able to generate profit due to discounts (bonuses) provided by partners. When applying a margin of 0%, profit is obtained due to discounts (bonuses) provided by partners. Taxes and other expenses are deducted from the profit, 90% of the net profit being distributed to the investor while the 10% going to IMAN. Take the invested amount of 1,000,000 sums from an investor who has made 300,000 sums of net profit. In this scenario, 270,000 sums of this net profit belongs to the investor and IMAN, now, owns the other 30,000 sums.

Where does IMAN channel its funds?

IMAN directs investments in order to finance goods and services within sectors such as healthcare, education, sports, electronics trading, and the likes of large and small household appliances, construction materials, and so on.

Is it also like a pyramid scheme?

In financial pyramids, the money of one investor is distributed to the second investor, meaning that investor money is simply redistributed with no net appreciation of the broader economy. However, our investments are dedicated to trading and lending, helping to stimulate the economic development of the region. All activities undertaken by our firm are done so strictly within the law - a stark contrast to pyramid schemes. We have several documents in place which regulate our legal relationship with investors: a Public Offer outlining the rights and obligations of all parties; and a Privacy Policy outlining how a users’ information will be stored and used.

Is the practice of % considered usury?

Using the “%” symbol does not necessarily imply interest-based transactions. It simply denotes that 1/100th part of something is being referred to. In Islamic finance, IMAN and investors enter into a Mudarabah contract, which allows them to trade goods such as household appliances, electronics, and furniture. As an example, if an investment of 1 million sums was made in order to trade products and there was a net profit of 300,000 sums after one year, then 90% of this profit would go to the investor and 10% would be given to IMAN. This equates to 27% return on the original investment. The only difference is that a usual market trader uses his own money or borrowed money whereas IMAN and investors trade in partnership, profits and losses being shared according to permissible regulations in Islamic finance.

Can I withdraw my investments before the end of the agreed-upon time frame?

If you decide to withdraw funds prior to the end of the selected term, your investment will be returned to you within 90 days from the date of submitting your request. The profits for the previous month will be computed according to a formula in the system that accounts for early withdrawal of investments.

IMAN representatives are in touch

Ask questions

Achieve your goals faster with IMAN